Navigating the intricate world of finance can be a daunting task. For those in Sydney seeking expert guidance to unlock pathways, turning to reputable finance brokerage solutions is crucial. These companies possess in-depth knowledge of the landscape and can assist individuals and businesses in acquiring the optimal financing options to realize their goals.

From mortgages and commercial loans to venture financing, a reliable finance brokerage can simplify the process, ensuring a seamless experience. Review these key criteria when selecting a Sydney finance brokerage:

* Experience in your specific sector

* A well-established network of lenders

* Clear Communication throughout the process

* Personalized solutions to meet your unique needs

A skilled finance brokerage can be a valuable advisor in helping you navigate the complexities of Sydney's financial world.

Securing Your Financial Future with a Sydney Finance Broker

Navigating the versatile world of finance can often feel overwhelming. Whether you're searching for your first home, growing your business, or simply wanting to improve your financial situation, a Sydney Finance Broker can be an invaluable resource. These experienced professionals possess extensive knowledge of the {financiallandscape and are committed to helping you realize your financial aspirations.

- A Sydney Finance Broker can present you with a spectrum of personalized {financialoptions to suit your individual needs and circumstances.

- Furthermore, they will arrange the best possible terms on your behalf, saving you time, effort, and possibly money.

- With their expert counsel, you can make savvy financial decisions that will fortify your financial future.

Top Mortgage Brokers in Sydney: Get Pre-Approved Today!

Securing your dream home in Sydney is easier than you think. With the services of a skilled mortgage broker, you can navigate the complex world of financing effortlessly. Their team of certified brokers are passionate to finding the best financing options to suit your individual needs and budget.

Getting pre-approved for a mortgage is a crucial first step in the home buying process. It provides you how much you can afford to borrow, improves your negotiating power with sellers, and speeds up the overall purchasing process. Avoid waiting any longer!

Contact our approachable mortgage brokers today for a complimentary consultation and take the first step towards owning your dream home .

Explore the Sydney Property Market with Our Finance Brokerage Services

The Sydney property market is notoriously competitive and complex. {Whether you're a first-time buyer, seasoned investor, or looking to refinance, securing the right finance package can make all the difference. That's where our expert team of loan consultants comes in. We assist you through every step of the process, from initial consultation to final approval. With years of experience, we'll negotiate competitive interest rates and loan terms tailored to your individual needs and goals.

- Our services include:

- Mortgage broking

- Investment lending

- Expert guidance

Don't let on your dream property in Sydney. Reach out to our finance brokerage team today for a no-obligation quote. Let us help you achieve financial success.

Choosing Top Finance Brokers in Sydney: Compare Rates & Save

Securing the most favorable finance broker in Sydney can be a challenging task. With so many options available, it's crucial to thoroughly compare rates and terms before making a decision.

A reputable broker will provide personalized advice based on your individual financial needs. They'll also endeavor to secure the attractive rates website from a variety of lenders.

Prior to making your final choice, review the herein factors:

* History

* Charges

* Satisfaction

* Lender network

By conducting thorough research and evaluating diverse brokers, you can maximize your chances of finding the suitable match for your financial needs.

Streamline Your Finances: Find a Trusted Sydney Finance Broker

Finding the ideal finance specialist in Sydney can be like navigating an maze.

You need someone that understands your individual financial needs, and who can assist you through the details of obtaining a loan.

A trusted broker can save you time and stress, by researching various loan options and negotiating on your behalf.

It's important to choose a specialist who is experienced and has a proven track record. Look for someone who is licensed by the Australian Securities and Investments Commission (ASIC).

Once you've found a couple potential advisors, arrange consultations with them to explain your financial goals.

Mason Gamble Then & Now!

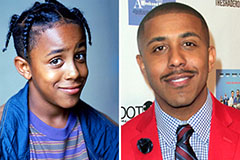

Mason Gamble Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!